Climate change poses huge challenges for the financial sector, too. The Bundesbank supports the transition to a low-carbon economy.

hide navigation Digital euroA digital euro would be a digital form of central bank money, specifically the euro. It could be used by the general public in much the same way as cash, only in virtual form. Alongside cash, the Eurosystem would thus supply households with an additional form of central bank money that can be used quickly, easily and securely.

hide navigation Statistics Time series databasesThe Bundesbank’s up-to-date statistical data in the form of time series (also available to download as a CSV file or SDMX-ML file).

hide navigation Bank sort codes searchHere you will find information on the bank sort code file and on the bank sort code update service. You can also download the bank sort code files.

hide navigationIn the press area, you will find press releases, speeches, guest contributions and interviews with Bundesbank Executive Board members as well as further press materials.

hide navigation PublicationsThe Bundesbank published various studies and conference proceedings, resulting from the research activities of its employees and guest researchers.

hide navigation Employer BundesbankAs an employer, we are committed to putting our employees first, because our success is founded on their knowledge, their skills and their contributions. Find out more about the Bundesbank as an employer.

hide navigationIn its mandate for managing direct debits the SEPA Direct Debit Scheme, which was introduced throughout the Single Euro Payments Area ( SEPA ) on 2 November 2009, contains provisions for the compulsory inclusion of a creditor identifier which provides a clear indication of the creditor without making reference to an account.

Together with the unique Mandate reference assigned by the direct debit creditor this Creditor Identifier is forwarded by the banking industry in the SEPA dataset all the way from the creditor to the debtor of the SEPA direct debit. Used in combination with the Creditor Identifier the unique Mandate reference makes it possible to identify a mandate clearly with the effect that when SEPA direct debit is presented to a debtor, he is able to check the effective existence of the mandate or alternativley that the Debtor Bank is able to offer him such a service optionaly.

In most European countries the direct debit procedures already make use of a national identifier of the direct debit creditor, which is administered by the payment system operators or, in some cases, also by the central bank (Belgium, France). Up to now, this kind of identifier has not featured in German direct debit procedures. It will therefore have to be introduced into the SEPA Direct Debit Scheme as a new element. In the case of Germany, the Deutsche Bundesbank assumes responsibility for issuing the Creditor Identifier in consultation with the German Banking Industry Committee ( GBIC ).

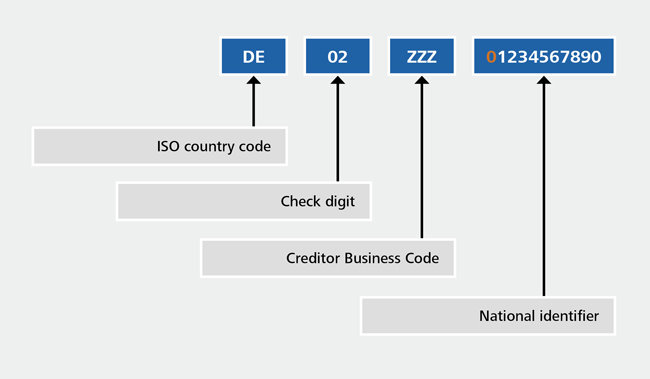

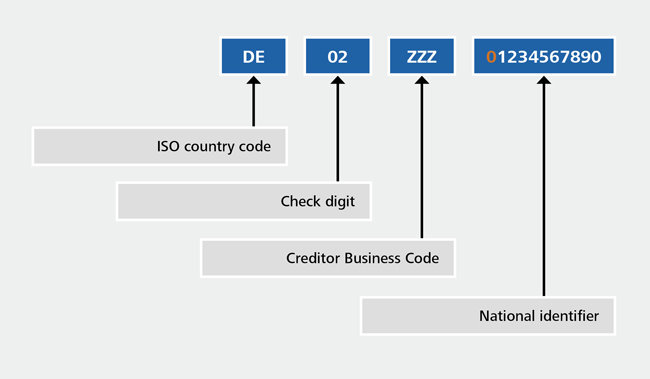

The structure of the Creditor Identifier has been standardised throughout the Single Euro Payments Area ( SEPA ). It is made up of the respective ISO country code, a check digit comprising 2 characters, the Creditor Business Code and a country-specific part, called the national identifier, which may vary in length but must not exceed 28 characters. The length of the Creditor Identifier therefore differs from country to country. However, it is never any longer than 35 characters.

The Creditor Identifier for Germany is precisely 18 characters in length and is structured as follows

Note: The diagram above shows only an example representation with check digit which has not been calculated in the correct manner!

The following Creditor Identifier containing a check digit which has been correctly calculated can be used for testing purposes: DE98ZZZ09999999999 .

The form that you require to apply for your Creditor Identifier can be found in the “Downloads” section at the bottom of this page.

Applications for the issuance of a Creditor Identifier can be made in electronic form only. Applications cannot be submitted in any other way. The prerequisite for the allocation of a Creditor Identifier by the Deutsche Bundesbank is that the direct debit creditor has its principal residence or principal office in Germany. Creditor Identifiers are assigned via e-mail.

Each direct debit creditor is given just one Creditor Identifier. If several applications are submitted only the first application will be considered. The direct debit creditor can, however, use the Creditor Business Code to flag specific units in his business where credit positions are collected via direct debit.

The allocation of a Creditor Identifier takes place independently of the legal status and economic situation of the applicant and should not be seen to contain any statement or evaluation in this respect from the Deutsche Bundesbank.

The allocation of a Creditor Identifier is not combined with approval to collect direct debits in the SEPA Direct Debit Scheme. This can only be carried out by the account-holding credit institution of the applicant.

There is a special "Creditor Identifier procedure description" for Creditor Identifier applications (see "Downloads"). This procedure must be followed exactly when submitting an application.

The current version of the “Creditor identifier procedure description” became effective on 21 May 2012. Since then, it is no longer necessary to apply for a new creditor identifier following a change of name, company name or shareholders, or following an identity-preserving change of legal form. The same applies to changes to a domestic business address or data relating to a contact person. Although it is not necessary to report the amended data to the Bundesbank, the direct debit creditor is nonetheless required, if requested to do so by the Bundesbank or his/her account-carrying payment service provider, to prove that his/her identity has been preserved following such changes.

The submission of an application takes place in connection with the legal form. After acknowledging the Creditor Identifier procedure description and the notes on the privacy policy, the group of persons corresponding to the legal form is then to be selected.

Selection of legal form

The following further information is required.

For security reasons, after entering the data you will be asked to enter a character string in a control box. Only then can the entry of the data be completed.

The data is encrypted for data transfer to increase security.

You will then receive an e-mail at the e-mail address given under the contact person data with the request to release the application data for further processing. If the data is not released within ten calendar days, the data is deleted and the application procedure terminated.

After the data has been successfully released, the Creditor Identifier is sent with a notification by e-mail to the e-mail address given.

For security reasons, the notification e-mail is encrypted with a digital signature. You can check that the digital signature is genuine by using the “Instructions for checking the digital signature” (see “Downloads”). The signature used on notification e-mails sent prior to 22 June 2010 can be checked using the “Instructions for checking the digital signature up until 21 June 2010” (see “Downloads”).

We would like to point out that applications are not processed in real-time, meaning that the e-mail may be sent after a period of several hours, depending on the workload.

The notification must be stored carefully as it is to be presented to the account-carrying payment service provider for admission to the SEPA Direct Debit Scheme. If it is lost we can make a second copy of the notification available, however this second copy can only be requested in writing (not by e-mail).

In accordance with the provisions of the Federal Data Protection Act (Bundesdatenschutzgesetz), the personal data collected in connection with the allocation and administration of Creditor Identifiers in the SEPA Direct Debit Scheme are collected, processed and used by the Bundesbank exclusively for this purpose; they are saved for as long as they are deemed necessary or until a written order is issued for their deletion. In agreement with the German banking industry, the Bundesbank will not publish any directory containing currently valid or deleted Creditor Identifiers.

If you have any questions regarding the Creditor Identifier, the application procedure or technical aspects (eg communication problems), please contact “Z 200-2”. The contact details can be found at the beginning of this page in the right column.